Start building your passive income today!

Introduction: Why Passive Income Matters

Did you know that 65% of self-made millionaires have at least three streams of income? Passive income is the key to financial freedom, allowing you to earn money with minimal ongoing effort. Whether you’re looking to escape the 9-to-5 grind, save for retirement, or achieve financial independence, this guide will explore the best passive income streams in 2024.

In this article, you’ll discover:

- What passive income really means

- Top 10 proven passive income ideas

- Common mistakes to avoid

- Expert strategies to maximize earnings

What Is Passive Income?

Passive income refers to earnings generated with little to no daily effort. Unlike a traditional job, where you trade time for money, passive income allows you to make money while you sleep. However, most passive income streams require upfront work or investment.

Active vs. Passive Income

- Active Income: Requires continuous work (e.g., salary, freelance gigs).

- Passive Income: Generates revenue with minimal maintenance (e.g., rental income, dividends).

Top 10 Passive Income Streams in 2024

1. Dividend Stocks & ETFs

Investing in dividend-paying stocks or ETFs allows you to earn regular payouts. Companies like Apple, Coca-Cola, and Procter & Gamble have a history of consistent dividends.

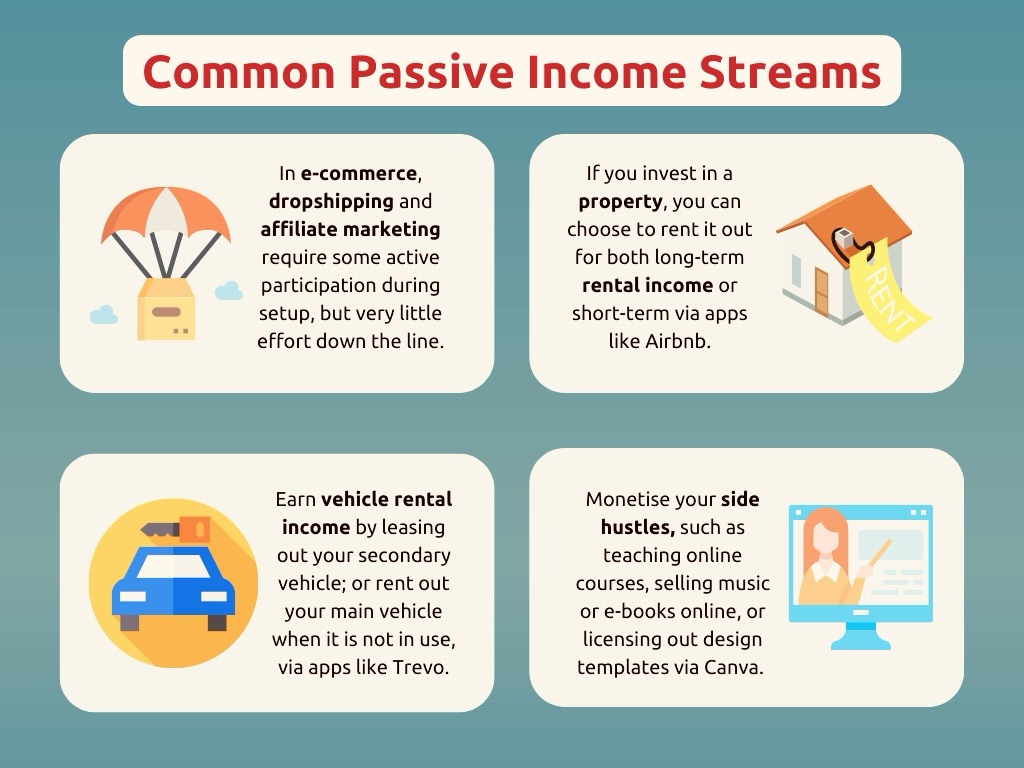

2. Rental Properties

Real estate remains one of the most reliable passive income sources. Platforms like Airbnb and VRBO make it easier to rent out properties short-term.

3. Create an Online Course

If you have expertise in a niche (e.g., coding, marketing, fitness), you can sell courses on platforms like Udemy, Teachable, or Kajabi.

4. Write an eBook

Self-publishing on Amazon Kindle Direct Publishing (KDP) can generate royalties for years with minimal upkeep.

5. Affiliate Marketing

Promote products through blogs, YouTube, or social media and earn commissions. Popular networks include Amazon Associates, ShareASale, and CJ Affiliate.

6. Peer-to-Peer Lending

Platforms like LendingClub and Prosper let you lend money to individuals or small businesses and earn interest.

7. Print-on-Demand Business

Sell custom-designed merchandise (T-shirts, mugs) without holding inventory using Printful, Teespring, or Redbubble.

8. YouTube Monetization

Create evergreen content (tutorials, reviews) and earn from ads, sponsorships, and memberships.

9. High-Yield Savings & CDs

While not entirely passive, high-yield savings accounts and certificates of deposit (CDs) offer low-risk returns.

10. Automated Dropshipping

Run an eCommerce store without handling inventory using Shopify and Oberlo.

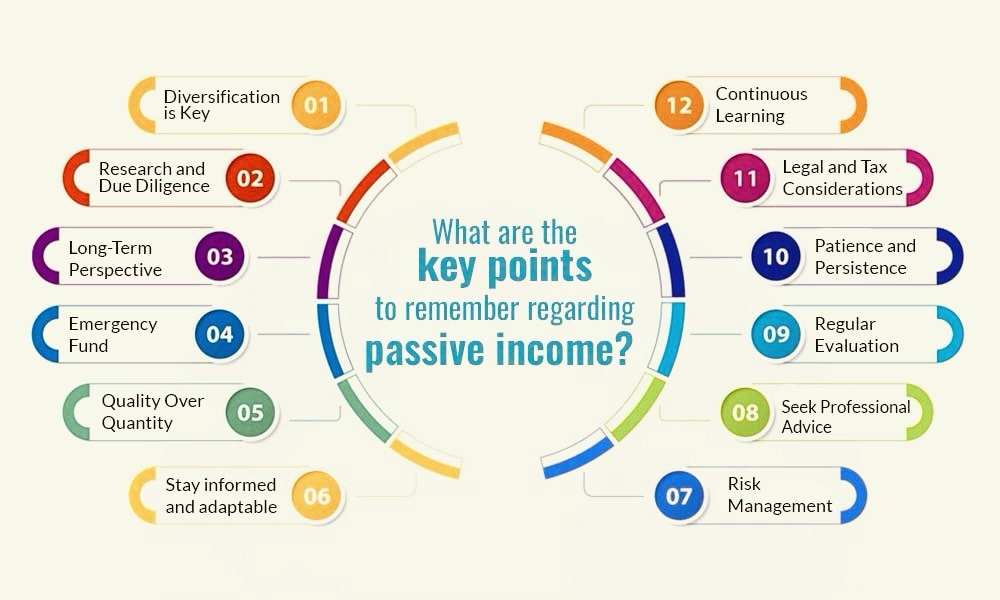

Common Passive Income Mistakes to Avoid

- Expecting overnight success – Most passive income takes time.

- Ignoring taxes – Passive earnings are still taxable.

- Overestimating returns – Research realistic profit margins.

Expert Tips to Maximize Passive Income

- Diversify income streams – Don’t rely on just one method.

- Reinvest profits – Compound growth accelerates earnings.

- Leverage automation – Use tools to minimize manual work.

Conclusion: Start Building Your Passive Income Today

Passive income isn’t a “get rich quick” scheme—it’s a long-term wealth-building strategy. By choosing the right streams and staying consistent, you can achieve financial freedom. Which passive income idea will you try first? Share your thoughts in the comments!

FAQs About Passive Income Streams

1. How much money can I make from passive income?

Earnings vary—some people make a few hundred dollars a month, while others generate six figures annually.

2. What’s the easiest passive income stream for beginners?

Affiliate marketing and dividend investing are great starting points.

3. Do I need money to start passive income?

Some methods (like investing) require capital, while others (like blogging) can start with minimal costs.

4. How long before I see results?

Most passive income streams take 3–12 months to gain traction.

5. Is passive income truly passive?

Most require initial effort, but maintenance is minimal compared to active income.

Looking for more financial tips? Check out our guides on side hustles and investing for beginners.

For further reading, visit Investopedia’s guide on passive income.