How to Save Money Fast: 25+ Real Tips That Work in 2025

Did you know that over 60% of Americans live paycheck to paycheck? If you’re looking for ways how to save money fast, you’re not alone. Whether it’s for an emergency fund, debt repayment, or a big purchase, quick savings strategies can make a huge difference.

In this guide, we’ll walk you through practical, easy-to-implement steps that anyone can use to start saving money — fast. No fluff, just real-life tips that work.

Why Saving Money Fast Matters

Saving money isn’t just about discipline; it’s about security and freedom. Emergencies happen, job markets shift, and opportunities arise. Having cash on hand gives you options.

According to a 2024 Bankrate survey, only 43% of U.S. adults could cover a $1,000 emergency expense using savings. The rest would rely on credit cards, loans, or borrowing from friends and family.

- Reduces financial stress

- Provides flexibility during life changes

- Opens doors to investment and growth

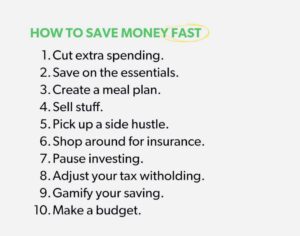

Step-by-Step Guide: How to Save Money Fast

Step 1: Set Clear Financial Goals

Start by defining exactly what you want to achieve. Instead of vague goals like “save more,” set specific targets:

- Save $1,000 in 30 days

- Reduce monthly expenses by 20%

- Build a $5,000 emergency fund in 90 days

Having clear, measurable goals keeps you motivated and focused.

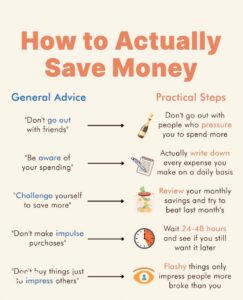

Step 2: Track Your Spending

You can’t manage what you don’t measure. Use apps like Mint or YNAB to track where your money goes each month.

Here’s what to look for:

- Subscriptions you no longer use

- Impulse purchases

- Unnecessary services

Step 3: Build a Zero-Based Budget

In a zero-based budget, every dollar has a job. Income minus expenses equals zero. This forces you to be intentional with your spending.

Example:

| Category | Budgeted | Spent |

|---|---|---|

| Rent | $1,200 | $1,200 |

| Groceries | $300 | $280 |

| Savings | $200 | $200 |

Best Practices for Quick Savings

Automate Your Savings

Set up automatic transfers to your savings account as soon as you get paid. Out of sight, out of mind!

Apps like Acorns round up your purchases and invest the change automatically.

Cut Non-Essential Subscriptions

We spend hundreds on subscriptions we barely use. Do a monthly audit and cancel unused services like:

- Streaming platforms

- Fitness memberships

- Meal kits

Use Cashback and Rewards Apps

Make everyday purchases work for you. Try these apps:

- Robinhood Gold – Investing perks

- Ibotta – Grocery rebates

- Swagbucks – Earn gift cards

Common Mistakes to Avoid When Trying to Save Money Fast

- Not tracking progress – Without benchmarks, you won’t know if you’re improving.

- Trying too many things at once – Start small and build momentum.

- Overestimating income – Always plan based on what you actually earn, not what you hope to earn.

Expert Insights & Case Studies

Interview with Personal Finance Coach

“One of the biggest misconceptions people have is that they need a perfect budget right away. In reality, it’s about consistency, not perfection.”

— Sarah Li Cain, Accredited Financial Counselor

Real-Life Example: How One Family Saved $2,000 in 6 Weeks

A young couple in Chicago saved $2,000 in two months by:

- Canceling unused subscriptions

- Using grocery coupons

- Switching to public transport

- Picking up freelance work

FAQs About Saving Money Fast

Can I really save $1,000 in a month?

Yes, with careful budgeting and extra income streams, many people successfully save $1,000 in 30 days.

What are the best apps for saving money quickly?

Top apps include YNAB, Mint, Acorns, and Ibotta. These help track spending, automate savings, and earn cashback.

How do I start saving when I’m in debt?

Begin with a micro-savings goal, like $10 per week. Even small amounts add up over time without hurting your debt payments.

Is saving money fast realistic?

It depends on your income, expenses, and commitment. With discipline, most people can find room to save more than they think.

Should I stop investing while trying to save money fast?

No, especially if your employer offers a 401(k) match. At minimum, contribute enough to get the full match before focusing entirely on savings.

Final Thoughts

Saving money fast doesn’t mean living in deprivation. It means making smart choices, cutting waste, and being proactive about your finances.

If you found this article helpful, leave a comment below with your favorite tip or share it with someone who needs a financial boost!

For more tips, check out our guides on smart budgeting and building an emergency fund.

Data sources: Bankrate, Investopedia