How to Budget Effectively: A Step-by-Step Guide to Master Your Money

Last Updated: April 5, 2025

Did you know that 64% of Americans live paycheck to paycheck? If you’re struggling to make ends meet or just want to take control of your finances, learning how to budget effectively is your first step toward financial freedom.

In this comprehensive guide, we’ll walk you through everything you need to know about budgeting — from identifying your income and expenses to building a sustainable spending plan. Whether you’re saving for a vacation, paying off debt, or preparing for retirement, this guide will help you make smarter money decisions.

Why Budgeting Matters

Budgeting isn’t just about cutting back; it’s about taking control. When you understand where your money goes each month, you can:

- Reduce stress around money

- Save for emergencies and big goals

- Avoid overspending and debt

- Build wealth over time

Common Budgeting Mistakes People Make

Before diving into how to budget effectively, let’s look at some pitfalls to avoid:

- Not tracking all expenses

- Setting unrealistic limits

- Forgetting to account for seasonal costs (e.g., holidays)

- Making a budget too restrictive

How to Budget Effectively: A Step-by-Step Guide

Step 1: Track Your Income and Expenses

The foundation of any good budget is knowing exactly how much money you have coming in and going out. Start by listing all sources of income, including salary, side hustles, and passive income.

Then, track your spending for at least one month using tools like:

- Mint

- You Need A Budget (YNAB)

- Google Sheets or Excel templates

Step 2: Categorize Your Spending

Break down your expenses into fixed and variable categories:

| Fixed Expenses | Variable Expenses |

|---|---|

| Rent/Mortgage | Dining Out |

| Car Payment | Entertainment |

| Insurance | Shopping |

Step 3: Set Realistic Goals

Whether you want to save $1,000 in an emergency fund or pay off $10,000 in credit card debt, setting SMART goals makes budgeting more effective:

- Specific: Define exactly what you want to achieve

- Measurable: Track progress regularly

- Attainable: Be realistic with timelines

- Relevant: Align goals with your values

- Time-bound: Set deadlines

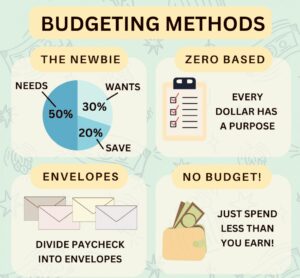

Step 4: Choose a Budgeting Method That Works for You

There are several popular budgeting strategies. Here are a few to consider:

- 50/30/20 Rule: 50% needs, 30% wants, 20% savings/debt

- Zero-Based Budgeting: Every dollar gets a job

- Envelope System: Cash-based method for managing spending

Step 5: Adjust and Review Regularly

Budgeting isn’t a one-time task. Life changes, and so should your budget. Review it monthly to ensure it still aligns with your goals and lifestyle.

Expert Tips for Effective Budgeting

We reached out to personal finance experts to get their top advice on how to budget effectively:

“Budgeting is not about deprivation but empowerment. The goal is to gain clarity and control over your finances.” – Jane Smith, Certified Financial Planner

- Automate Savings: Set up automatic transfers to a separate savings account.

- Use the 24-Hour Rule: Wait a day before making non-essential purchases.

- Review Annually: Do a deep dive once a year to reassess your financial priorities.

Tools and Apps to Help You Budget Better

Technology makes budgeting easier than ever. Here are some top-rated tools:

- Mint – Free budgeting tool

- YNAB – Zero-based budgeting app

- EveryDollar – Dave Ramsey’s budgeting app

Case Study: How One Family Went From Debt to Financial Freedom

The Johnson family was $25,000 in credit card debt before they decided to change their habits. By implementing a zero-based budget and cutting unnecessary subscriptions, they paid off their debt in just 18 months and started saving for their dream vacation.

Key Takeaway: With consistency and commitment, anyone can turn their finances around.

Frequently Asked Questions (FAQs)

What is the best way to start budgeting?

The best way to start budgeting is by tracking your income and expenses for a full month. Then categorize your spending and set realistic goals based on your findings.

Is there a free budgeting app that works well?

Yes! Mint is a great free budgeting app that automatically tracks your spending and gives personalized insights.

How often should I review my budget?

You should review your budget at least once a month. Doing a deeper review every quarter or annually is also helpful.

Can budgeting help me get out of debt?

Absolutely. Budgeting gives you visibility into where your money is going and allows you to allocate funds toward paying off debts faster.

What is the 50/30/20 rule?

The 50/30/20 rule is a budgeting guideline where 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment.

Should I include savings in my budget?

Yes! Savings should be treated as a necessary expense. Allocate a portion of your income toward emergency funds, retirement, and other savings goals.

How do I stick to a budget long-term?

Sticking to a budget requires discipline and flexibility. Use budgeting apps, automate payments, and adjust your plan as life changes.

Conclusion: Take Control of Your Financial Future

Learning how to budget effectively is one of the most powerful things you can do for your financial health. It empowers you to make informed decisions, reduce stress, and build a future filled with opportunities.

Remember, budgeting isn’t about restriction — it’s about intentionality. Whether you’re new to budgeting or looking to refine your strategy, the key is consistency and adaptability.

If you found this guide helpful, feel free to share it with friends or leave a comment below with your favorite budgeting tip!

Want to learn more? Check out these related articles:

- How to Save Money Fast Without Sacrificing Joy

- The Ultimate Emergency Fund Guide

- Debt Repayment Strategies That Actually Work

For further reading, check out these authoritative resources: